Introduction

- Briefly explain the importance of tax preparation and how it can be overwhelming for many individuals.

- Mention that this blog post will provide five tips to simplify the tax season and make the process hassle-free.

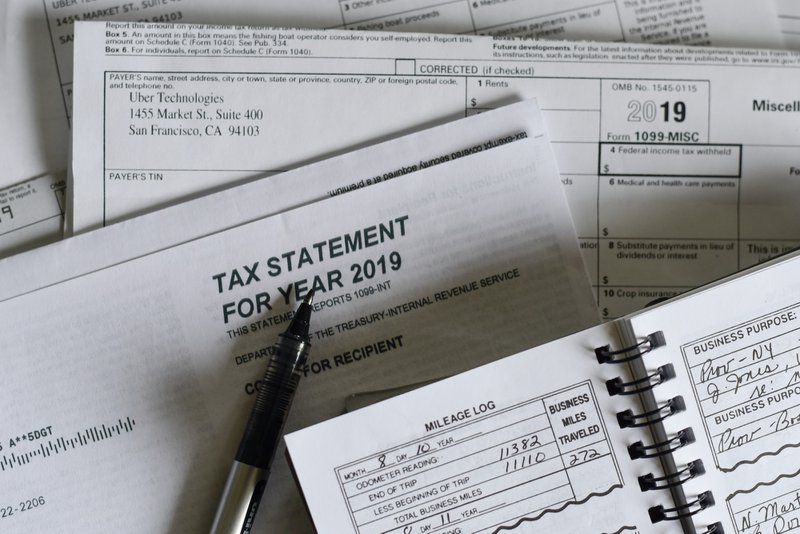

Tip 1: Gather All Necessary Documents

- Explain the importance of gathering all necessary documents, such as W-2 forms, 1099 forms, and receipts.

- Provide suggestions on organizing these documents effectively to avoid any last-minute scrambling.

Tip 2: Stay Updated with Tax Law Changes

- Highlight the significance of staying informed about any changes in tax laws that may affect your tax return.

- Offer resources or websites where readers can find reliable information on tax law updates.

Tip 3: Utilize Tax Preparation Software or Hire a Professional

- Discuss the benefits of using tax preparation software, such as TurboTax or H&R Block, to streamline the process.

- Alternatively, suggest hiring a professional accountant or tax preparer for those who prefer expert assistance.

Tip 4: Maximize Deductions and Credits

- Explain the concept of deductions and credits and how they can help reduce taxable income.

- Provide examples of common deductions and credits that individuals may qualify for, such as education expenses or home office deductions.

Tip 5: File Your Taxes Early

- Emphasize the advantages of filing taxes early, including avoiding last-minute stress and potential penalties for late filing.

- Encourage readers to set a deadline for themselves to ensure timely filing.

Conclusion

- Summarize the five tips mentioned in the blog post.

- Reiterate how following these tips can simplify the tax season and make it a hassle-free experience.

- Encourage readers to start implementing these tips to have a smoother tax preparation journey.

by

Tags:

This site is registered on wpml.org as a development site. Switch to a production site key to remove this banner.